The Valuation and Pricing Process

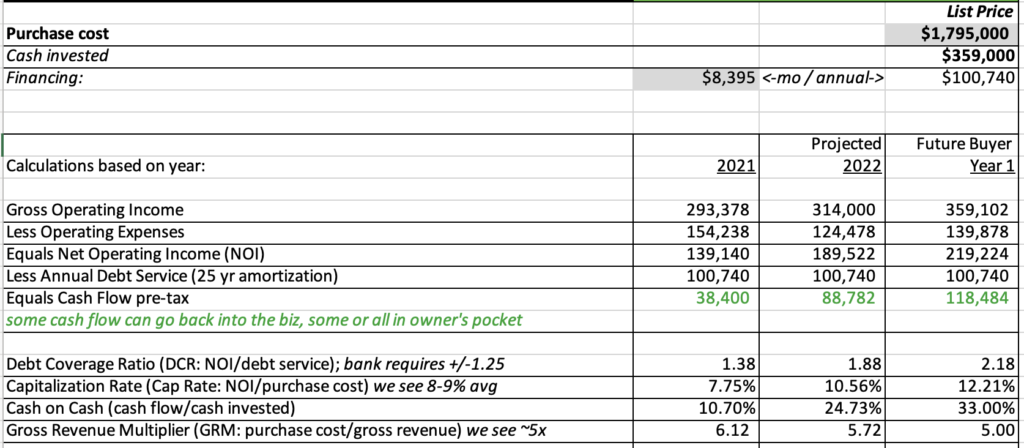

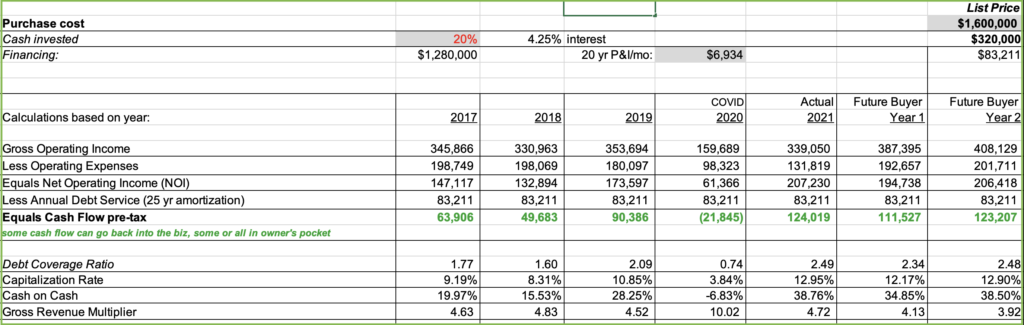

A common question… How did you or the seller come up with the price? Take a look at a sample calculation below based on a price of $1,500,000, with 20% down at 7.5% interest, amortized over 25 years. There are three key metrics we look at when backing into a price that is financeable: 1) […]

The Valuation and Pricing Process Read More »