So many financial terms….do you understand what you’re looking at? Your first step, other than working with me as your investment specialist, is to understand the metrics.

GRM: GROSS REVENUE MULTIPLIER

DCR: DEBT COVERAGE RATIO

8 CAP: 8% CAP RATE

COC: CASH ON CASH

ADR: AVERAGE DAILY RATE

RevPAR: REVENUE PER AVAILABLE ROOM

OCCUPANCY (ANNUALIZED AND WHEN OPEN)

NOI: NET OPERATING INCOME

STABILIZED NOI

And the list goes on and on.

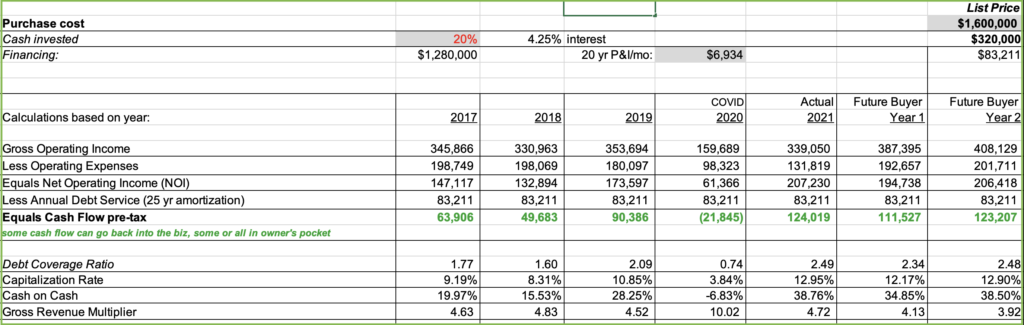

So how do we value inns in general? I go through the same process an appraiser does. I analyze the profit and loss statements to gain a full understanding of the financial operation as it exists now. And because I’ve looked at so many profit and loss statements in my career, I know what is ‘normal’ and ‘customary’ for the industry. So when I see expenses out of line with what I typically see, I question the expenses, to come up with a ‘normalized’ operation. I look closely at the largest expense categories: marketing, wages, repairs & maintenance, lodging operating supplies and food. I might see, for example, two person owner operator who might be getting older, they’ve owned it for many years, aren’t operating as to maximize every dollar, aren’t active in social media, and they’re leaving room for a buyer to do that. They may have more staff do the work that could or perhaps should be done by a new two-person hands on, owner/operator. So often there are possible adjustments to be made to the wages line item. And then I look at the detail in the R&M (repairs & maintenance) category to determine if they’ve expensed items such as replacement mattresses, furniture, painting, etc, which are rather improvements and not operational expenses. Maybe the marketing expense included a new website (which can cost anywhere from $5k-$15k unless a DIY site). You can see that these expenses at first glance to appear very high, which reduces the bottom line, pretty simple math. But this is why it’s critical to have an understanding of the operating expenses vs improvement expenses, for a buyer to know what is ‘normalized’ operation. Are they hiring out the $100/hr jobs (marketing, bookkeeping, revenue management) and doing the $20/hr jobs (housekeeping, laundry, etc) themselves? If you are too busy working IN your business (the $20/hr jobs) you don’t have time to work ON your business (the $100/hr jobs).

Then once I understand the financial operation, I can understand the room rates relative to their occupancy and if they are operating to the supply and demand of the market. And I look at their ADR and then the current condition of the inn and rooms and amenities offered. Is the perceived value too high? Too low? Just right? Are they active in social media or if not, has that affected their business? Are their competitors active? Are they using yield management to respond to the supply and demand and adjust rates accordingly?

So once I have a complete understanding of the operation as it exists, I can them come up with a future projection based on new buyer’s operation. This helps a buyer see what they can do differently to increase the top and bottom line. Increasing the top is important, but increasing the bottom line is critical. And understanding what affects increasing the bottom vs the top is critical.

Now I am able to come up with a defensible price that falls in line with the bank’s minimum DCR, within the range of GRM and cap rate we see for the subject type of hospitality property, and a cash flow or COC (cash on cash) return that satisfies the buyer. When the metrics all fall in line, we have arrived at a very non-subjective, methodical list price or value.

I have metrics of most of my hospitality sales, at least dating back to 2012, that I share with appraisers. And they share data with me. This is important so that I know when I list or value a property, I am using the same metrics as the appraisers. And ultimately we try to come up with a value that will appraise. There are other metrics such as revenue per room, price per room, average days on market, percentage of purchase price to list price, etc that we record as well which are helpful in other ways.

When I represent a buyer, I go through the same process as I do when I list a property for a seller, where I provide a financial offering that includes such data. This is why it’s so important to work with a hospitality investment broker!