A question I am asked quite regularly that I thought I’d provide a quick education!

🏡 The Appraisal Process

What Buyers & Sellers Need to Know

✅ Step-by-Step Process

1️⃣ Bank request – Loan officer asks their appraisal department to request bids from approved appraisers.

2️⃣ Bids – Appraisers submit their fee + turnaround time.

3️⃣ Options shared – Bank provides only fee & timeline (not appraiser’s name).

4️⃣ Buyer choice – Buyer selects an option & pays the bank (usually by credit card).

5️⃣ Engagement – Bank engages the chosen appraiser.

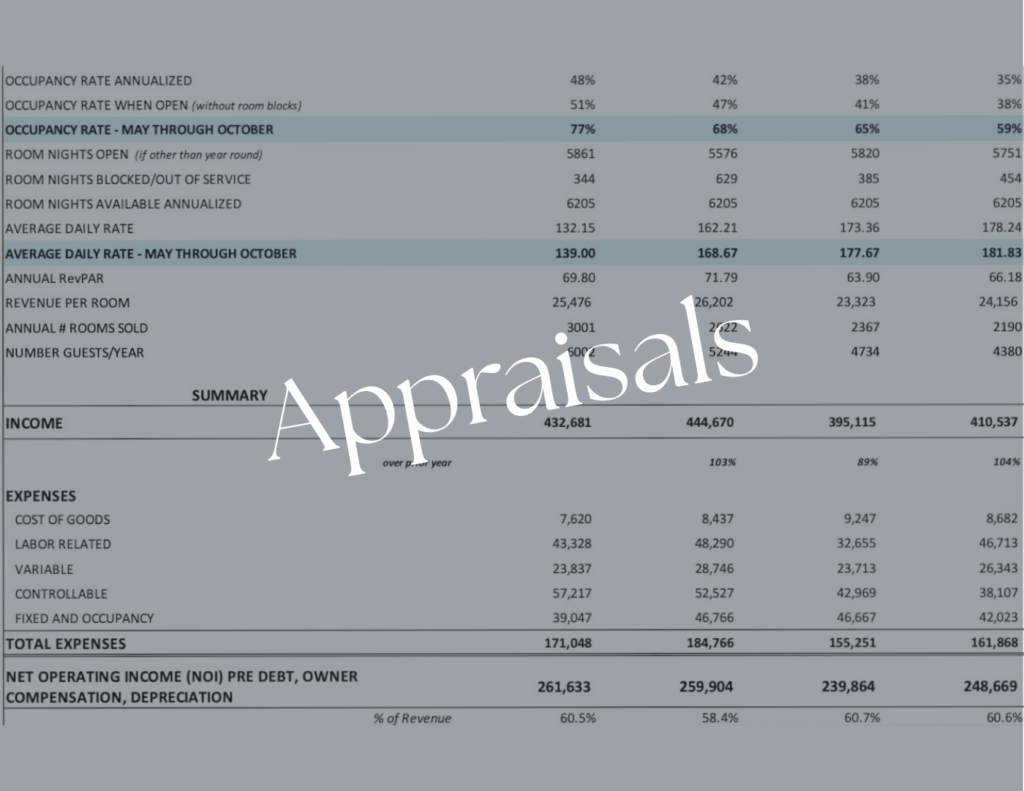

6️⃣ Scheduling – Appraiser contacts listing agent to schedule a site visit + request property financials.

💡 Buyer Options & Considerations

⏩ Order early – Buyer can request appraisal ahead of due diligence to help accelerate closing.

🔄 Switching banks – Appraisal can only transfer if: • New bank has the same appraiser on its approved list and • Original bank agrees to release it.

⚡ Rush appraisal – Buyer may request faster turnaround; appraisers may charge a higher fee.

⏱ Typical Timeline

📅 Appraisal turnaround: 3–6 weeks (depends on appraiser’s workload)

📑 Bank review: 3–5 days after report is received

✍️ Clear to close: Attorneys & bank prepare documents; closing usually within 3–5 business days

✅ Key takeaway: The appraisal must be managed by the bank to meet lending standards. Independent appraisals cannot be used for financing.