A bed and breakfast/lodging property is a hybrid – clearly it’s a home or a dwelling of sorts, it has land, and it has a business it operates within the real estate. But when we talk in terms of financing a business, we are talking business value and not real estate value.

So, let’s do the math…

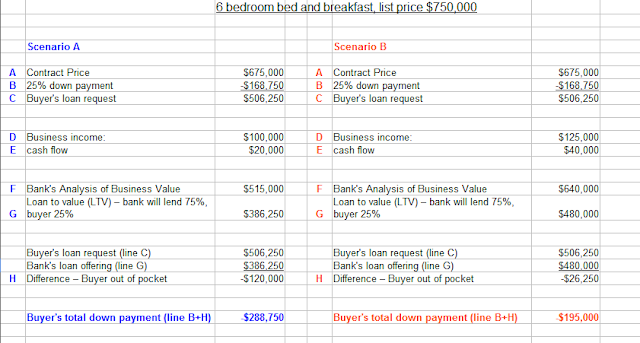

Often when buyers start their bed and breakfast search, they assume they’ll obtain a residential loan: 20% down for a 30 year term. And that’s just not the case. If the existing use of a property is a business and a buyer is looking to continue with that use, they’re going to have to obtain a commercial loan. This means 25-30% down for a 20-25 year term at a slightly higher interest rate. However, the criteria that must be met in order to obtain the commercial loan is very different from a residential loan. The bank will look at how the business is performing; they’ll look at the gross income, the cash flow and the capitalization rate (cap rate). Put simply, if the cash flow is inadequate, the bank will not lend as much. They’ll base their loan amount on the business performance. Using simple numbers, let’s assume a 6 room bed and breakfast is under contract for $675,000. The buyer at this point is hoping to put down $168,500 (25%). Now, let’s assume the inn’s gross income is $100,000, expenses are $80,000 (including mortgage for this exercise) with a cash flow of $20,000. The bank informs the buyer that they would really like to see a stronger cash flow. Based on the business analysis, the bank feels the business will support a sales price of $515,000. The bank will lend 75% of loan-to-value, or LTV which equals $386,250. Given that the agreed upon sales price is $675,000, the buyer is now facing a required down payment of $288,750. Let’s assume the gross income was $125,000 and the cash flow around $40,000, in this scenario, the bank might say that the business will support a sales price of $640,000, lend 75% or $480,000 leaving the buyer with a down payment of $195,000. If the buyer has to put down an additional $26,500 to make the deal work, negotiations might be tough but they could work. If a buyer is looking at having to put down an additional $120,250 to make it work, chances are the deal will fall through. I’ve seen sellers come down a great deal in price to make the deal work when the bank can’t get the appraisal up to the agreed upon sales price but I’ve also seen deals fall through.

What we see in this exercise (other than the obvious possible dead deal) is what an additional $25,000 in gross income can do to the business value. This might help visualize it:

So the seller responds to the buyer’s agent with “my property has a higher residential value”; this may very well be the case. But it’s the business value that matters when the use will remain the same. Sellers often ask if the buyer can obtain a residential loan and use the residential appraisal and the answer is sometimes, yes. However, the buyer would have to qualify on the purchase of the property as their primary residence based on their current income. If they’re leaving their jobs to purchase a bed and breakfast, they can’t apply for a residential loan based on their income. If the buyers have an alternative source of income, then they increase their chance of being able to work on creative financing.

So what can the seller do to increase their bottom line? Most importantly, try to increase the business – it’s what will most greatly affect the value of your business.